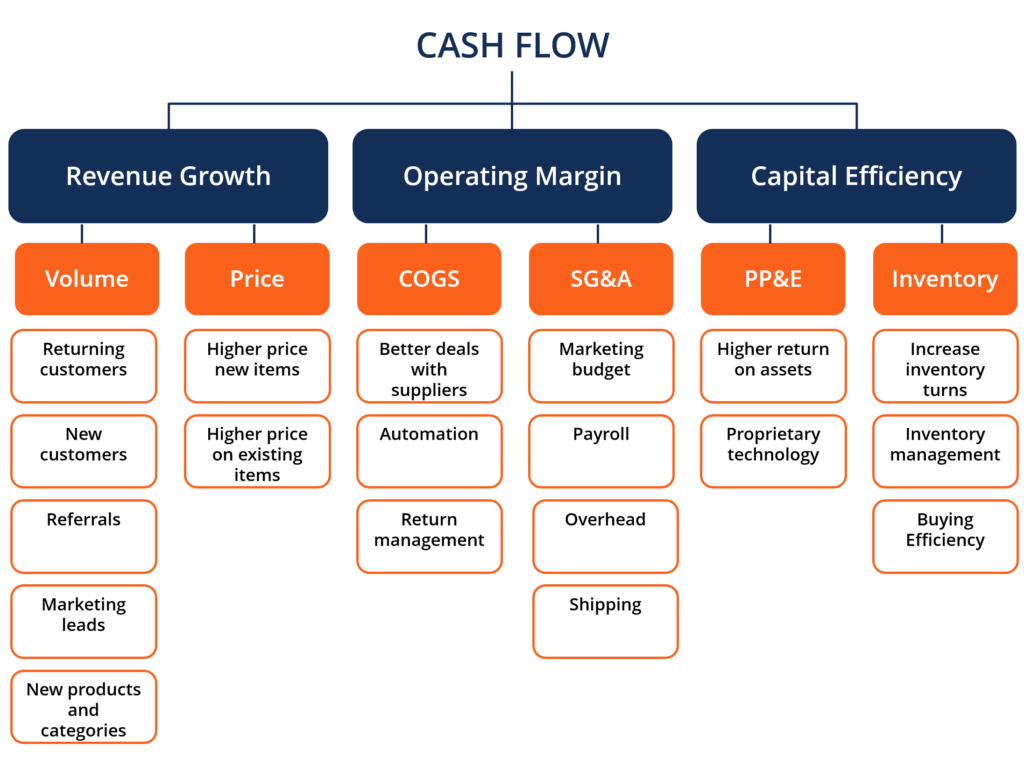

The Coronavirus (COVID-19) pandemic has created extreme economic pressures on many businesses and cashflow management must be a priority over the coming months. Effective cashflow management will enable businesses to weather this unprecedented disruption as best they can and hopefully be in a stronger position to recover and grow once this difficult period is over.

Below are some of the critical actions businesses should be looking at now in order to manage and retain their cash effectively.

1. Prepare a 13 week short term cash flow forecast to identify what your business' cash position looks like on an ongoing basis. This should be a rolling document that is used as a management tool not only to assess what payments can/should be made but also to ensure all parts of your business perform as well as they can.

2. Review your direct debits and standing orders to ascertain which payments are business critical.

3. Scenario planning

4. Loan (capital) repayment holidays

5. Time to pay government taxes

6. Support for businesses that pay rates

7. Overhead reduction

8. Managing staff costs

9. Determine whether your staffing levels are adequate and seek advice if you need to reduce the work force/hours. Consider utilising the government's new Job Retention Scheme.

10. Coronavirus business interruption loan scheme ("CBILS")

11. Cut non-essential expenditure

12. Debtor collection

13. Current and future sales

14. Other sources of funds - owners capital injection and other government initiatives

15. Prioritising supplier payments

16. Be creative

In addition to the above, it is important to note that company directors have to ensure that they continue to comply with their statutory obligations under various pieces of legislation, including (but not limited to) employment, health and safety and company laws.

And finally, communicate, communicate, communicate!

The emergence of non-bank lenders and challenger banks in the market place has not only provided competition on pricing but also access to a variety of new finance products. If you are looking to secure funding we are able to use our extensive experience and market insight to guide you through this process.

We offer hands-on assistance through the process of raising capital, from initial assessment and strategy to successful execution. Our capital sources provide solutions across the spectrum. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate working capital opportunities at more favorable rates and terms than many of our clients could obtain independently. We provide the approach to define your capital financing objectives after understanding your working capital needs for uninterrupted business .

When a company announces a distressed situation; this is in most cases, the result of an extensive impact involving important economic, legal, tax and accounting decisions; bankruptcy, excessive debt and regulatory constraints. A restructuring exercise can turn into a fairly high-profile event, and it is crucial to the future of the company that the end-to-end process is managed with great sensitivity, confidentiality and efficiency.

Adan's experience:

Adan's team of professionals have substantial experience in financial restructuring and executing the sales of distressed assets to maximize recoveries for investors

and creditors. We evaluate a full range of considerations including market conditions, liquidity needs, and legal and regulatory issues to identify the most efficient transaction solution.

We frequently draw upon the expertise of our restructuring and insolvency colleagues and their experience of advising on investing in companies in distressed situations, purchasing assets and businesses out of companies in distressed situations and restructuring companies near and in insolvency. We provide expert support throughout the entire lifecycle, delivered by local and global teams. This enables us to help banks create liquidity and unlock capital for reinvestment in other value adding lending activity benefitting the firm more broadly.

Our broad client base includes debtors, secured and unsecured creditors (including financial institutions, mezzanine investors, insurance companies, bondholders and landlords), creditor committees, special opportunity/situation investors, directors/officers and insolvency practitioners. Through working with these clients our team of professionals have gained valuable insights into the approaches of key stakeholders across the capital structure, and have developed and delivered innovative and practical solutions such as:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.