We work in a range of areas - from conventional industries such as mining to high-tech such as AR/VR.

Our partners are based in 19 countries across 3 continents and our networks span the globe.

Our deal value ranges between $1 mn and $500 mn and our focus is the mid-market segment

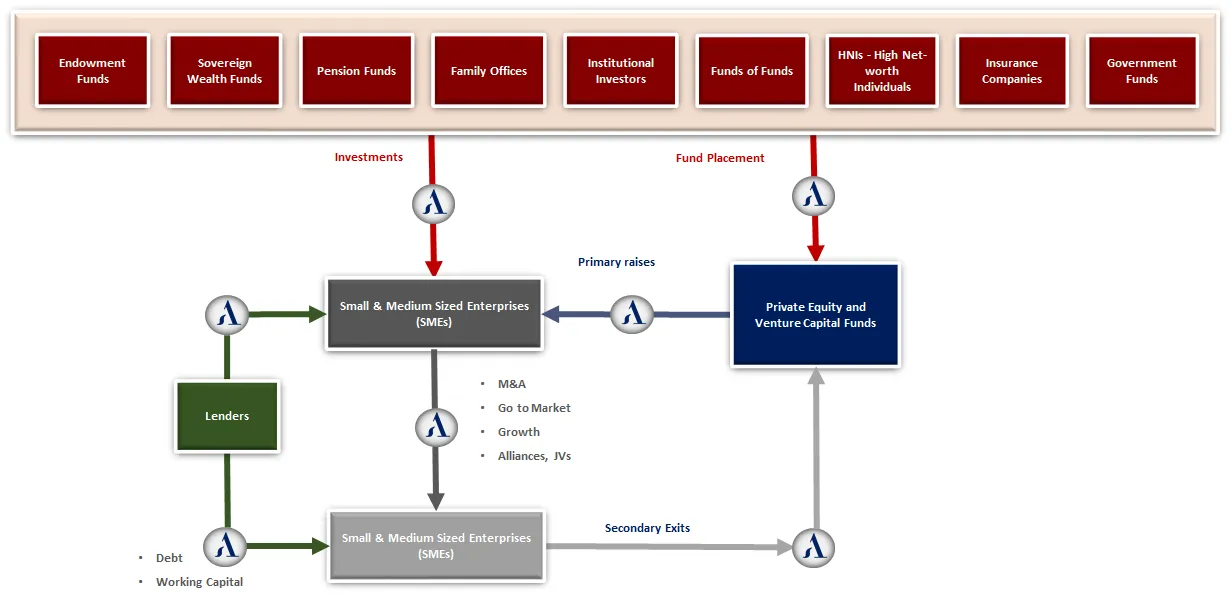

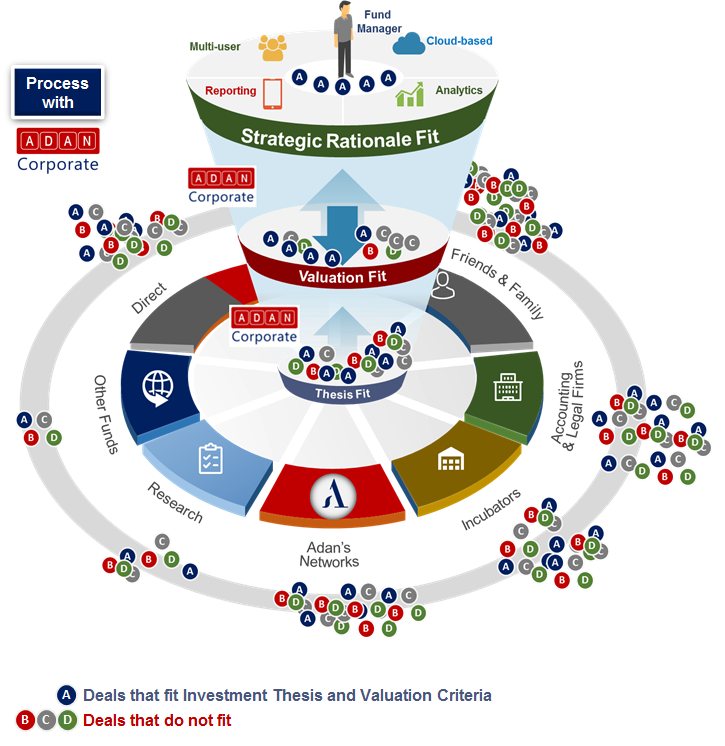

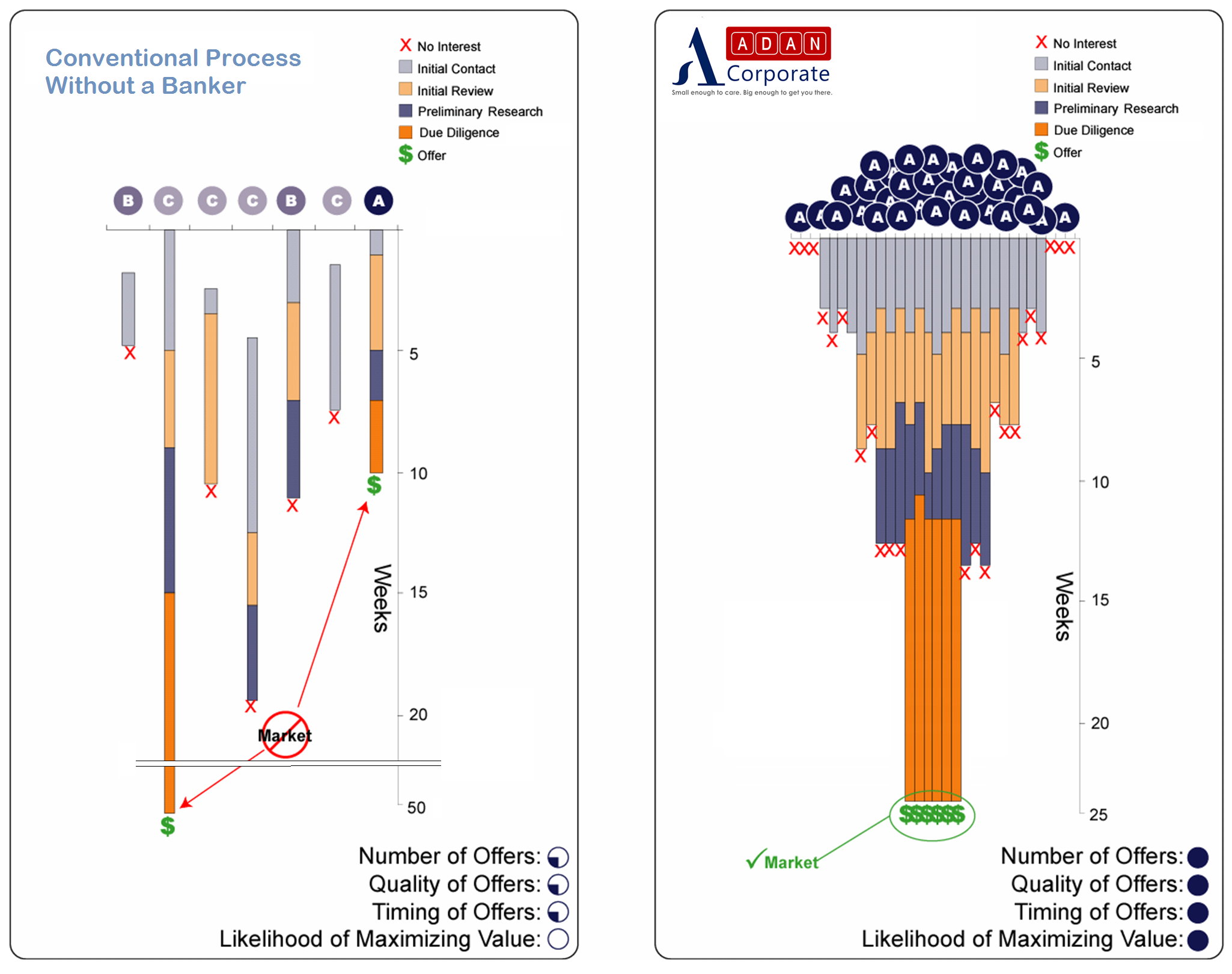

We provide a wide range of bespoke services to SMEs and Funds at every step of the value creation journey.