A joint venture is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. A joint venture differs from a merger in the sense that there is no transfer of ownership in the deal. Joint ventures are often entered into for a single purpose - a production or research activity. But they may also be formed for a continuing purpose.

Joint ventures can be informal (a handshake) or formal, and they can be short term or long term. Often the joint venture creates a separate business entity, to which the owners contribute assets, have equity, and agree on how this entity may be managed. The new entity may be a corporation, limited liability company, or partnership.

A true joint venture is generally considered to be a full alliance in which an independent entity is created, involving two or more partners. The concept of an entity an organisational form having separate structure and identity from the participating partners is central to the joint venture concept and differentiates it from other types of collaborative relationship.

With the increase in risk, innovation and market complexities, in order to safeguard own image and not to get disturbed with a new set of activities, firms come together to set up new firm in joint control with agreed conditions of sharing profits.

Companies typically pursue joint ventures for one of four reasons:

Some of those goals are easily translated into financial figures like "percentage of increased profits," "who incurs which expenses," and "increased product offerings". Other reasons include:

Requirements for Joint Ventures

A JV can be brought about in the following major ways:

Challenges:

A joint venture concept is only effective when there is a true willingness to move forward together. Not even signed contracts have value if mutual trust

and acceptance of the terms are not present. It is actually better not to consider a joint venture project if motives from either side are questioned by

the other side. A graceful exit before any legal obligation takes effect will most likely prevent an inevitable failure.

The models and structure of the joint venture keep on changing with the passage of time. Daily new innovations are coming in joint ventures, which not only gives better functionality but also flexibility in obtain fundings and to operate in the required field of work. Joint ventures are much more preferable as compared to partnership firms as there exists minimal risk only until the capital brought into the venture. Moreover, at the global level, this is considered to be the safest mode of entry in any market.

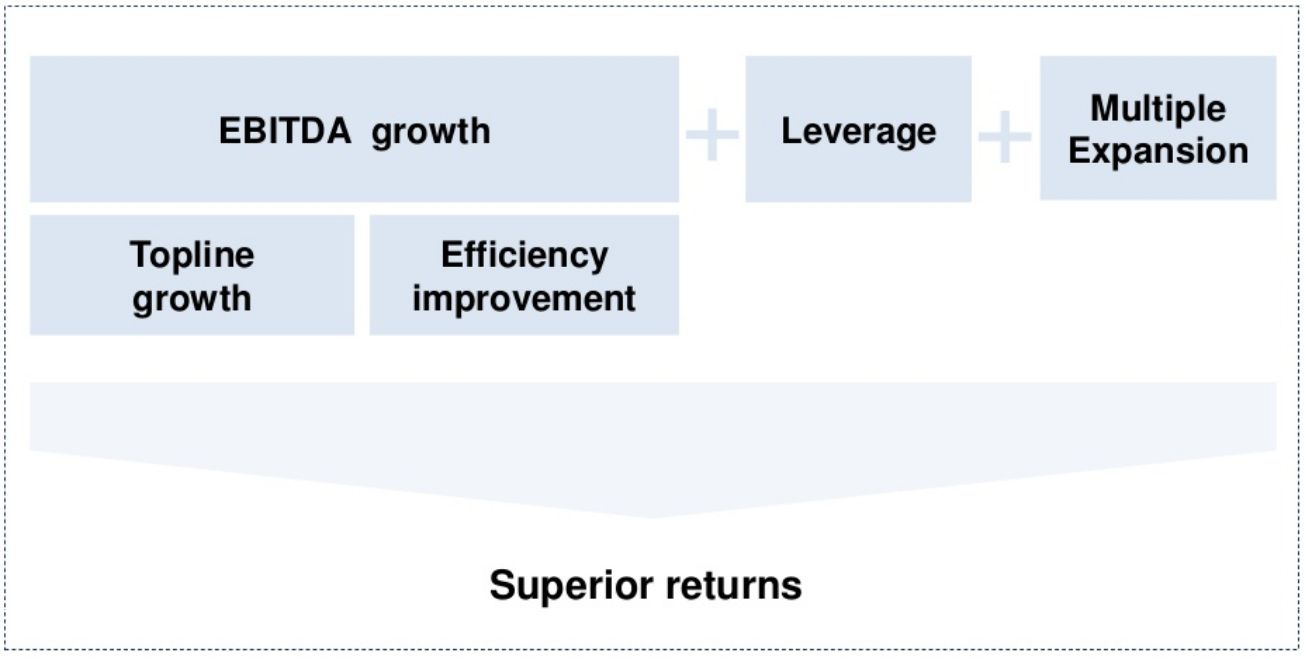

In today's highly competitive market, spotting value creation opportunities as well as understanding risk pre acquisition is key to driving value on completion and under ownership. Our Private Equity team works with our specialist sector teams which enables us to provide insights across all business sectors. This in turn helps facilitate the identification of strategic opportunities for JVs.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.