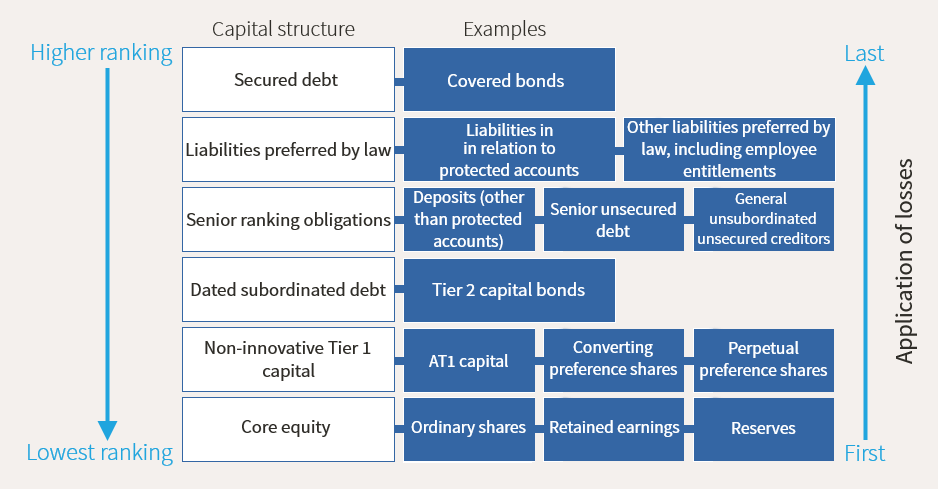

Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid.

What is Cost of Capital?

Cost of capital is the minimum rate of return that a business must earn before generating value. Before a business can turn a profit, it must at least

generate sufficient income to cover the cost of the capital it uses to fund its operations. Cost of capital consists of both the cost of debt and the cost

of equity used for financing a business. A company's cost of capital depends to a large extent on the type of financing the company chooses to rely on.

The company may rely solely on equity or debt, or use a combination of the two.

The choice of financing makes the cost of capital a crucial variable for every company, as it will determine the company's capital structure. Companies look for the optimal mix of financing that provides adequate funding and that minimizes the cost of capital.

In addition, investors use cost of capital as one of the financial metrics they consider in evaluating companies as potential investments. The cost of capital figure is also important because it is used as the discount rate for the company's free cash flows in the DCF analysis model.

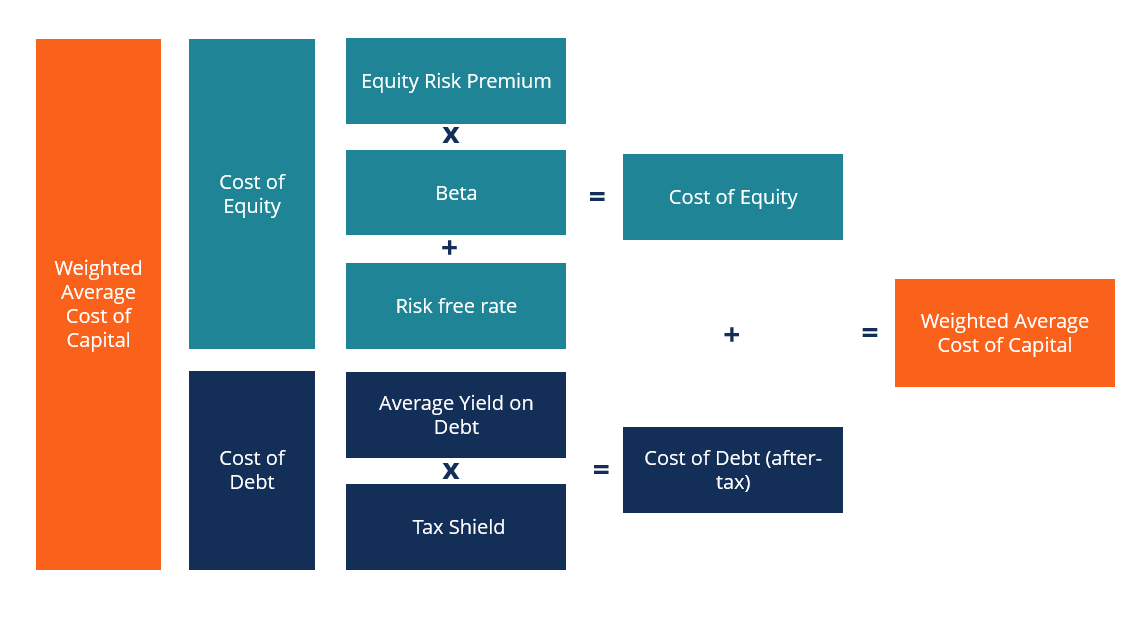

The most common approach to calculating the cost of capital is to use the Weighted Average Cost of Capital (WACC). Under this method, all sources of financing are included in the calculation and each source is given a weight relative to its proportion in the company's capital structure. WACC provides us a formula to calculate the cost of capital:

Cost of debt in WACC is the interest rate that a company pays on its existing debt. Cost of equity is the expected rate of return for the company's shareholders.

Debt is a cheaper source of financing as compared to equity. Companies can benefit from their debt instruments by expensing the interest payments made on existing debt and thereby reducing the company's taxable income. These reductions in tax liability are known as tax shields. Tax shields are crucial to companies because they help to preserve the company's cash flows and the total value of the company.

However, at some point, the cost of issuing additional debt will exceed the cost of issuing new equity. For a company with a lot of debt, adding new debt will increase its risk of default, the inability to meet its financial obligations. A higher default risk will increase the cost of debt, as new lenders will ask for a premium to be paid for the higher default risk. In addition, a high default risk may also drive the cost of equity up because shareholders will likely also expect a premium for taking on additional risk.

The emergence of non-bank lenders and challenger banks in the market place has not only provided competition on pricing but also access to a variety of new finance products. If you are looking to secure funding we are able to use our extensive experience and market insight to guide you through this process.

Our capital sources provide solutions across the spectrum, from fully amortizing long-term debt and non-recourse construction transactions to a highly leveraged mezzanine or bridge deal. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate debt placement opportunities at more favorable rates and terms than many of our clients could obtain independently.

We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals. We provide services in the below areas:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.