As travelers cancel flights, businesses ask workers to stay home, and stocks fall, a global health crisis becomes a global economic crisis. We are helping our clients assess the growing impact of novel coronavirus (COVID-19) on business and trade and share insights on how your organisation needs to plan its response.

Beyond the human tragedy, there is a direct economic impact from lives lost in an outbreak. Families and loved ones lose that income and their in-kind contributions to household income such as childcare. Of note, the distribution of COVID-19 fatalities skews old, which means many of those most likely to die are no longer working and are less likely to be the primary provider for their families.

Economic estimates of the likely global impact vary dramatically, with Orlik and others at Bloomberg hypothesizing $2.7 trillion in lost output, the Asian Development Bank releasing scenarios from $77 billion to $347 billion, and an OECD report talking about a halving of global economic growth.

We have outlined the 'high impact' factors outlined in our Coronavirus Risk Matrix to assess how employee disruption, supply chain (API) disruption and

reduction in demand are impacted by recent steps taken to reduce the movement of people and products in an effort to prevent contamination.

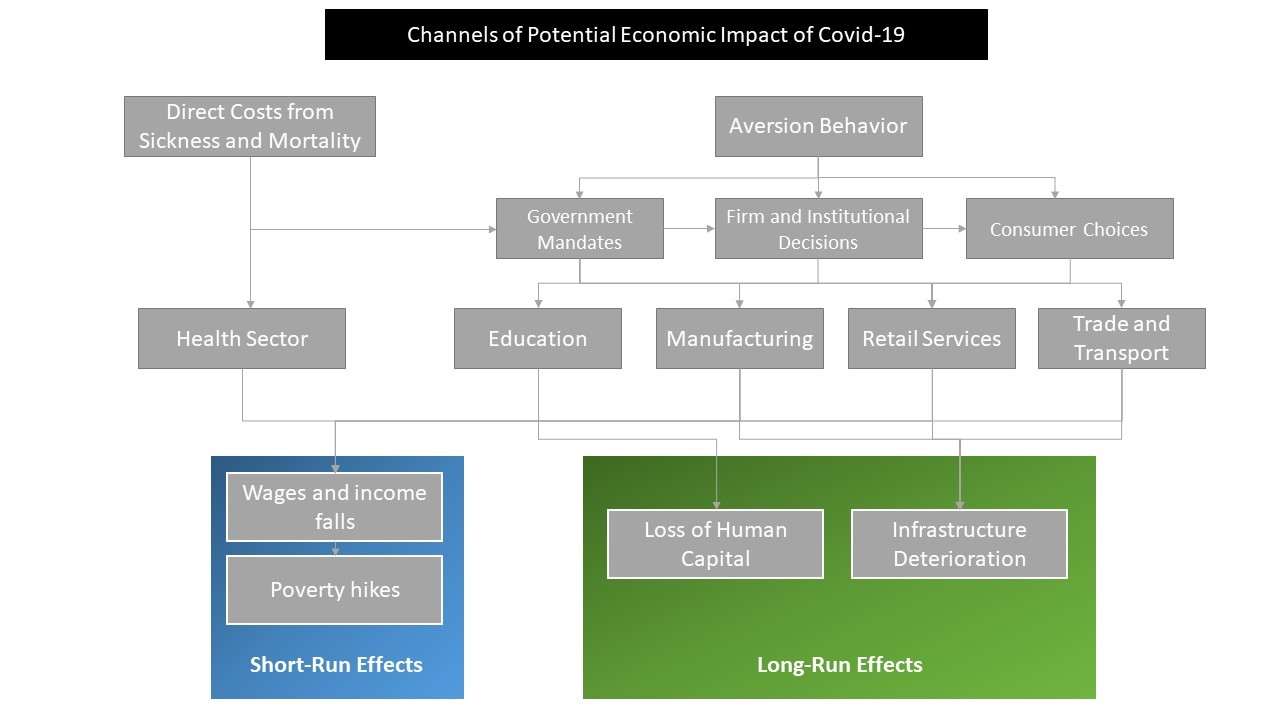

Most of the economic impact of the virus will be as we are already seeing from aversion behavior, the actions people take to avoid catching the virus (which can, it should be noted, be a logical and proportional response).

These actions affect all sectors of the economy - the health sector, manufacturing, retail and other services, trade and transportation, education, and others. These in turn translate into reduced income both through the supply side (reduced production drives up prices for consumers) and the demand side (reduced demand from consumers hurts business owners and their employees).

These short-term economic impacts can translate into reductions in long-term growth.

When a company announces a distressed situation; this is in most cases, the result of an extensive impact involving important economic, legal, tax and accounting decisions; bankruptcy, excessive debt and regulatory constraints. A restructuring exercise can turn into a fairly high-profile event, and it is crucial to the future of the company that the end-to-end process is managed with great sensitivity, confidentiality and efficiency.

Adan's experience:

Adan's team of professionals have substantial experience in financial restructuring and executing the sales of distressed assets to maximize recoveries for investors

and creditors. We evaluate a full range of considerations including market conditions, liquidity needs, and legal and regulatory issues to identify the most efficient transaction solution.

We frequently draw upon the expertise of our restructuring and insolvency colleagues and their experience of advising on investing in companies in distressed situations, purchasing assets and businesses out of companies in distressed situations and restructuring companies near and in insolvency. We provide expert support throughout the entire lifecycle, delivered by local and global teams. This enables us to help banks create liquidity and unlock capital for reinvestment in other value adding lending activity benefitting the firm more broadly.

Our broad client base includes debtors, secured and unsecured creditors (including financial institutions, mezzanine investors, insurance companies, bondholders and landlords), creditor committees, special opportunity/situation investors, directors/officers and insolvency practitioners. Through working with these clients our team of professionals have gained valuable insights into the approaches of key stakeholders across the capital structure, and have developed and delivered innovative and practical solutions such as:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.