The family office concept has its roots back in the 6th century. Then a majordomo was a person who would speak, make arrangements, or take charge for the affairs of the royal family and its wealth. Later in the 6th century, the upper nobility started to use these services of the majordomo as well. Hence, the concept of administratorship was invented and has prevailed until today.

The modern concept and understanding of family offices was developed in the 19th century. In 1838, the family of J.P. Morgan founded the House of Morgan, which managed the families' assets and in 1882, the Rockefellers founded their family office, which prevailed until today.

Many family offices have started their business as so called single family offices, where the family owns the family office and serves only the owner family. Instead of covering the entire operative costs, many owners of single family offices decided to offer its services to other families as well. This concept is called multi-family office or multi-client family office. Only a few multi-family offices have founded their business independently, without a large family backing it.

Single Family Office (SFO)

A Single Family Office (SFO) is a private company of professionals who are dedicated exclusively to the investment, personal and legacy needs of one family. The concept of an SFO can be traced back to the Roman major domus (head of the house) and the medieval major-domo (chief steward) estate as well as the British landed estate. The modern SFO originated in the 19th century by family dynasties who accumulated significant wealth created during the American industrial age.

Interest in SFOs has grown during the last twenty years with a new wave of worldwide wealth coupled with global economic turmoil of the past decade. Extreme volatility, banking and business failures and investment fraud, has motivated many families of significant wealth to take control of their financial affairs and preserve their family legacy.

Often, we find that families have been managing their wealth as a single portfolio, but many families find it helpful to break their wealth into three compartments. This way they have varying levels of control, transparency, cost, and personal involvement across different asset types that typically no single firm will be great at executing on for you. In other words, you typically can be more effective if you start thinking of your wealth in terms of your diversified assets, cash flowing real estate holdings, and direct investments into operating businesses. We can have this conversation with you, and what we have seen other centimillionaires do while managing the complexities of having dozens of LLCs, ever more complicated tax filings, and 100?s of investments in their portfolio.

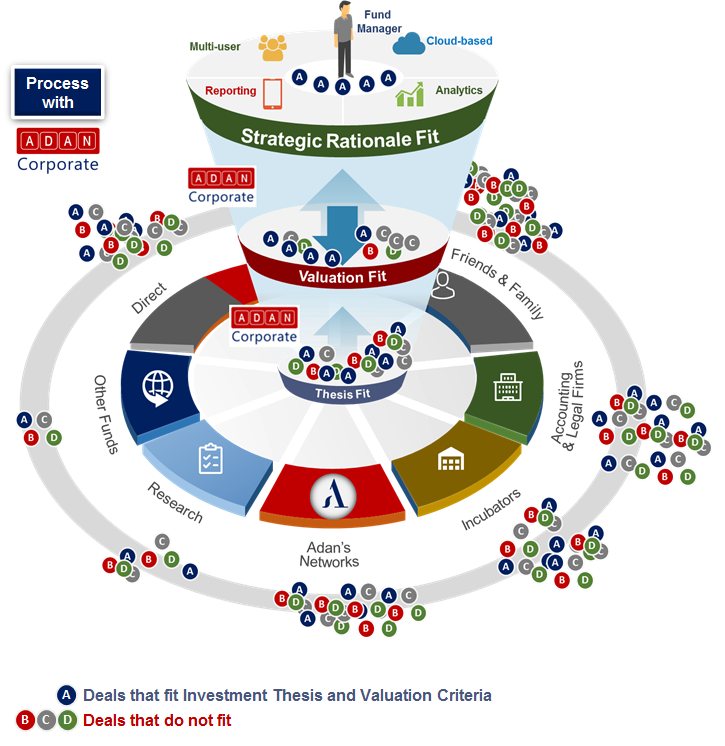

While many families reach out to us just before or after a liquidity event to design and implement their family office from the ground up, we can also help with the formalization of a family office, or helping improve key areas of a family office that has been in place for generations. We have found most families need to improve their operational management, direct investment deal flow programs, their family office dashboard, estate planning, and tax optimization.

Multi Family Office (MFO)

Multi-family offices typically provide a variety of services including tax and estate planning, risk management, objective financial counsel, trusteeship, lifestyle management, coordination of professionals, investment advice, and foundation management. Some multi-family offices are also known to offer personal services such as managing household staff and making travel arrangements. Because the customized services offered by a multi-family office can be costly, clients of a multi-family office typically have a net worth in excess of $50 million.[1]

A multi-family office (MFO) is a commercial enterprise established to meet the investment, estate planning and, in some cases, the lifestyle and tax service needs of affluent families.

MFOs can be created in one of three ways:

MFOs tend to have the following characteristics:

Reach out to us to schedule a video call to learn more about how we could work together to build out your family office solution or develop a performance-fee only direct investment program.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.