What Is Market Risk?

Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the

financial markets in which he or she is involved. Market risk, also called "systematic risk," cannot be eliminated through

diversification, though it can be hedged against in other ways. Sources of market risk include recessions, political turmoil,

changes in interest rates, natural disasters and terrorist attacks. Systematic, or market risk tends to influence the entire

market at the same time.

This can be contrasted with unsystematic risk, which is unique to a specific company or industry. Also known as "nonsystematic risk," "specific risk," "diversifiable risk" or "residual risk," in the context of an investment portfolio, unsystematic risk can be reduced through diversification.

Understanding Market Risk

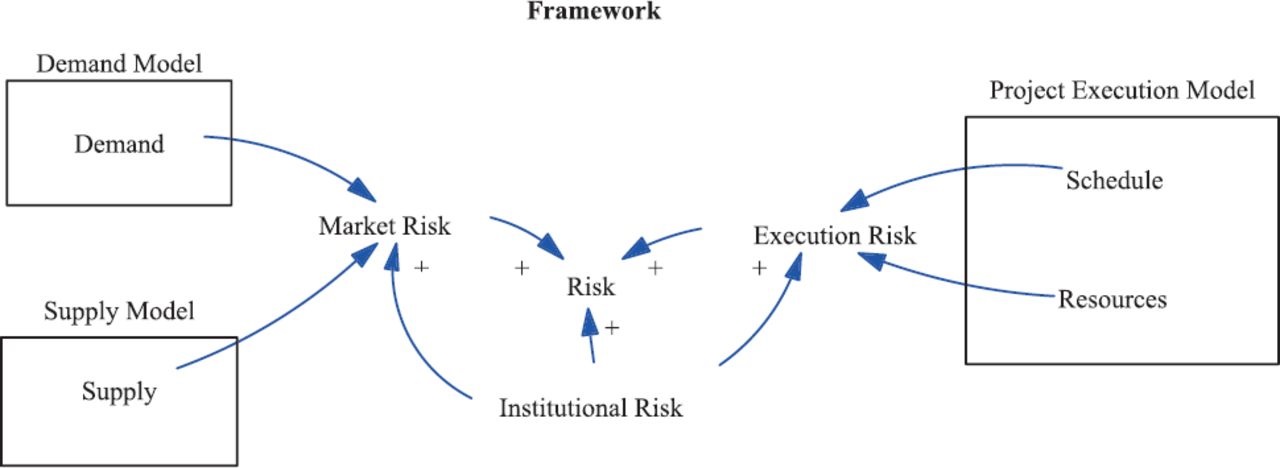

Market (systematic) risk and specific risk (unsystematic) make up the two major categories of investment risk. The most common types

of market risks include interest rate risk, equity risk, currency risk and commodity risk.

Publicly traded companies in the United States are required by the Securities and Exchange Commission (SEC) to disclose how their productivity and results may be linked to the performance of the financial markets. This requirement is meant to detail a company's exposure to financial risk.1? For example, a company providing derivative investments or foreign exchange futures may be more exposed to financial risk than companies that do not provide these types of investments. This information helps investors and traders make decisions based on their own risk management rules.

In contrast to market risk, specific risk or "unsystematic risk" is tied directly to the performance of a particular security and can be protected against through investment diversification. One example of unsystematic risk is a company declaring bankruptcy, thereby making its stock worthless to investors.

Main Types of Market Risk

Interest rate risk covers the volatility that may accompany interest rate fluctuations due to fundamental factors, such as central

bank announcements related to changes in monetary policy. This risk is most relevant to investments in fixed-income securities,

such as bonds.

Equity risk is the risk involved in the changing prices of stock investments, and commodity risk covers the changing prices of commodities such as crude oil and corn.

Currency risk, or exchange-rate risk, arises from the change in the price of one currency in relation to another. Investors or firms holding assets in another country are subject to currency risk.

Volatility and Hedging Market Risk

Market risk exists because of price changes. The standard deviation of changes in the prices of stocks, currencies or commodities

is referred to as price volatility. Volatility is rated in annualized terms and may be expressed as an absolute number, such as $10,

or a percentage of the initial value, such as 10%.

Investors can utilize hedging strategies to protect against volatility and market risk. Targeting specific securities, investors can buy put options to protect against a downside move, and investors who want to hedge a large portfolio of stocks can utilize index options. Measuring Market Risk

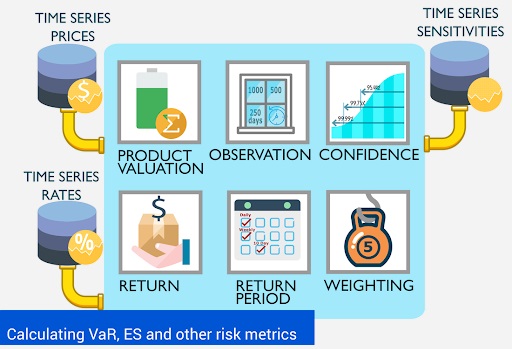

To measure market risk, investors and analysts use the value-at-risk (VaR) method. VaR modeling is a statistical risk management method that quantifies a stock or portfolio's potential loss as well as the probability of that potential loss occurring. While well-known and widely utilized, the VaR method requires certain assumptions that limit its precision. For example, it assumes that the makeup and content of the portfolio being measured is unchanged over a specified period. Though this may be acceptable for short-term horizons, it may provide less accurate measurements for long-term investments.

Beta is another relevant risk metric, as it measures the volatility or market risk of a security or portfolio in comparison to the market as a whole. It is used in the capital asset pricing model (CAPM) to calculate the expected return of an asset.

The variance covariance and historical simulation approach to calculating VaR assumes that historical correlations are stable and will not change in the future or breakdown under times of market stress. However these assumptions are inappropriate as during periods of high volatility and market turbulence, historical correlations tend to break down. Intuitively, this is evident during a financial crisis where all industry sectors experience a significant increase in correlations, as opposed to an upward trending market. This phenomenon is also known as asymmetric correlations or asymmetric dependence. Rather than using the historical simulation, Monte-Carlo simulations with well-specified multivariate models are an excellent alternative.

For example, to improve the estimation of the variance-covariance matrix, one can generate a forecast of asset distributions via Monte-Carlo simulation based upon the Gaussian copula and well-specified marginals.[4] Allowing the modelling process to allow for empirical characteristics in stock returns such as auto-regression, asymmetric volatility, skewness, and kurtosis is important. Not accounting for these attributes lead to severe estimation error in the correlation and variance-covariance that have negative biases (as much as 70% of the true values).[5] Estimation of VaR or CVaR for large portfolios of assets using the variance-covariance matrix may be inappropriate if the underlying returns distributions exhibit asymmetric dependence. In such scenarios, vine copulas that allow for asymmetric dependence (e.g., Clayton, Rotated Gumbel) across portfolios of assets are most appropriate in the calculation of tail risk using VaR or CVaR.

Besides, care has to be taken regarding the intervening cash flow, embedded options, changes in floating rate interest rates of the financial positions in the portfolio. They cannot be ignored if their impact can be large.

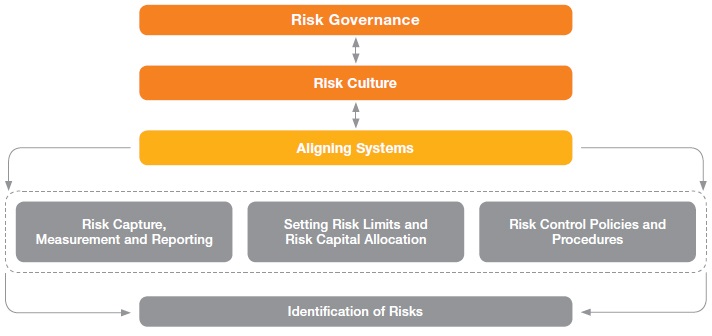

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.