Growing regulatory environment, higher business complexity and increased focus on accountability have led enterprises to pursue a broad range of governance, risk and compliance initiatives across the organization. However, these initiatives are uncoordinated in an era when risks are interdependent and controls are shared. As a result, these initiatives get planned and managed in silos, which potentially increases the overall business risk for the organization. In addition, parallel compliance and risk initiatives lead to duplication of efforts and cause costs to spiral out of control. Governance, Risk, and Compliance process through control, definition, enforcement, and monitoring has the ability to coordinate and integrate these initiatives.

A governance, risk, and compliance (GRC) framework is an effective method of identifying and mitigating threats to your company that you wouldn't even have recognized in the first place. No business wishes to be taken by surprise when an audit reveals noncompliance. Compliance risk management is aimed at helping organizations avoid such a situation.

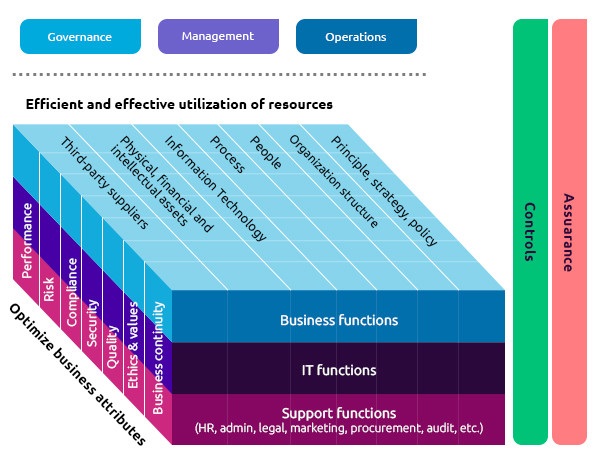

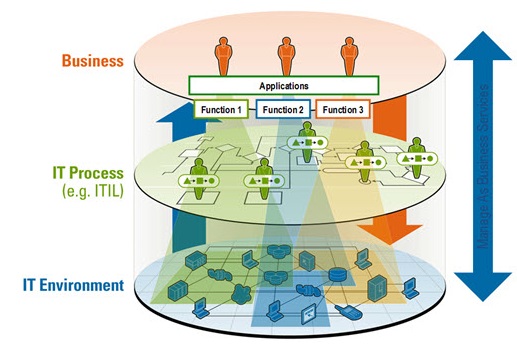

Most organizations have an approach to their GRC requirements and the maturity ranges from an ad hoc structure to a robust mature framework. A successful IT GRC strategy is one that aligns itself to the organizations Objectives, Culture and Values. A mature organization has IT GRC practices as part of its Organization strategy and operations while being supported by a range of technology and knowledge base. Adan's approach in building a successful IT GRC strategy eliminates siloed view of Information security and aims at integrated security culture and practices that better assist organizations in handling security risks and align to organization goals. Adan offers an implementable and successful Enterprise Architecture framework that has enabled our customers with a robust framework to manage Governance, Risk and Compliance successfully.

The GRC framework is all of managing a company's overall governance, enterprise risk management, and compliance through regulations. Consider it a structured approach to aligning your business objectives with IT while effectively meeting compliance demands and managing risks. While GRC is important for all companies, it is especially crucial for those dealing with EU citizens in the aftermath of the General Data Protection Regulation (GDPR).

The span of a Governance, Risk and Compliance process includes three elements:

1. Governance is the oversight role and the process by which companies manage and mitigate business risks

2. Risk management enables an organization to evaluate all relevant business and regulatory risks and controls and monitor mitigation actions in a structured manner

3. Compliance ensures that an organization has the processes and internal controls to meet the requirements imposed by governmental bodies, regulators, industry mandates or internal policies.

1. Governance: With an increase in activism among shareholders and increased scrutiny from the regulatory bodies, corporate boards and executive teams are more focused on governance related issues than ever before. The governance process within n organization includes elements such as definition and communication of corporate control, key policies, enterprise risk management, regulatory and compliance management and oversight (e.g., compliance with ethics and options compliance as well as overall oversight of regulatory issues) and evaluating business performance through balanced scorecards, risk scorecards and operational dashboards. A governance process integrates all these elements into a coherent process to drive corporate governance.

2. Risk Management: With the recent jump in regulatory mandates and increasingly activist shareholders, many organizations have become sensitized to identifying and managing areas of risk in their business: whether it is financial, operational, IT, brand or reputation related risk. These risks are no longer considered the sole responsibility of specialists - executives and the boards demand visibility into exposure and status so they can effectively manage the organization's long-term strategies. As a result, companies are looking to systemically identify, measure, prioritize and respond to all types of risk in the business, and then manage any exposure accordingly. A risk management process provides a strategic orientation for companies of all sizes in all geographies with a formal process to identify, measure and manage risk.

3. Compliance: An initiative to comply with a regulation typically begins as a project as companies race to meet deadlines to comply with that regulation. These projects consume significant resources as meeting the deadline becomes the most important objective. However, compliance is not a one-time event - organizations realize that they need to make it into a repeatable process, so that they can continue to sustain compliance with that regulation at a lower cost than for the first deadline. When an organization is dealing with multiple regulations at the same time, a streamlined process of managing compliance with each of these initiatives is critical, or else, costs can spiral out of control and the risk of non-compliance increases. The compliance process enables organizations to make compliance repeatable and hence enables them to sustain it on an ongoing basis at a lower cost.

Benefits of Taking an Integrated GRC Approach

Many organizations find themselves managing their governance, risk and compliance initiatives in silos - each initiative managed separately even if reporting

needs overlap. Even though, each of these initiatives individually follow the governance, risk and compliance process outlined above, when they deployed software

solutions to enable these processes, the selections were made in a very tactical manner, without a thought for a broader set of requirements. As a result,

organizations have ended up with dozens of such systems to manage individual governance, risk and compliance initiatives, each operating in its own silo.

Majority of the Fortune 1000 organizations find themselves in this situation today. However, they are quickly finding that as the multiple risk and compliance initiatives become more intertwined from regulatory and organizational perspectives, multiple systems cause confusion due to duplicative and contradictory processes and documentation. In addition, the redundancy of work, as well as sheer expense of maintaining multiple point software solutions causes the cost of compliance to spiral out of control.

By taking an integrated GRC process approach and deploying a single system to manage the multiple governance, risk and compliance initiatives across the

organization, the issues listed above can be easily addressed. Such an approach can :

* Have a dramatic positive impact on organizational effectiveness by providing a clear, unambiguous process and a single point of reference for the organization

* Eliminate all redundant work in various initiatives

* Eliminate duplicative software, hardware, training and rollout costs as multiple governance, risk and compliance initiatives can be managed with one software solution

* Provide a "single version of the truth" available to employees, management, auditors and regulatory bodies

It is critical that a GRC solution must be able to address a wide range of compliance and risk management initiatives so that an organization can leverage GRC to deploy a consistent framework across the organization for compliance and risk management. Many vendors window dress their point solution by re-labeling it as a GRC solution or adding support for a few additional regulations to claim multi-regulatory label.

Capabilities of the GRC solution include:

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.