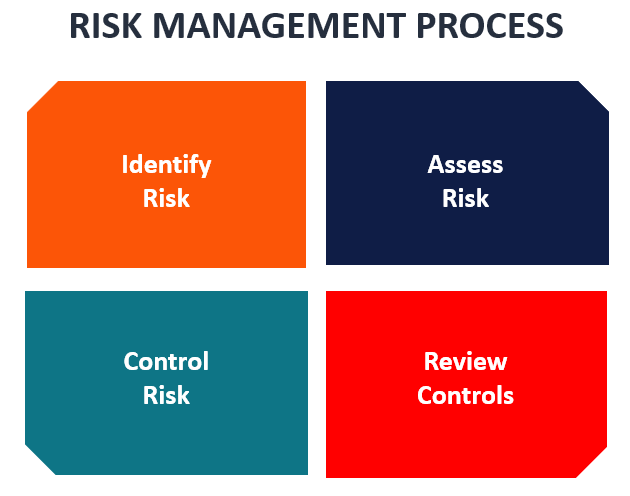

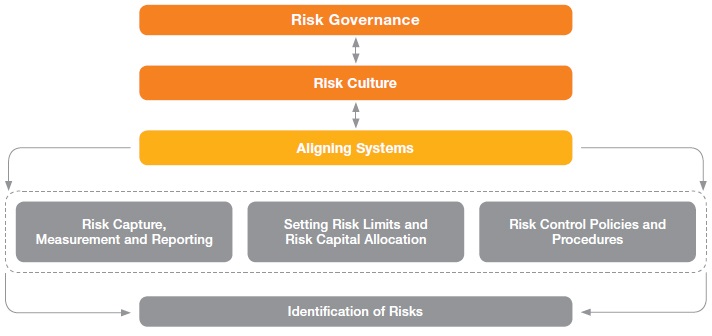

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Risk management is essential in any business. It lays foresight for returns on investments and projects all potential backlash a company could face by starting a new (or even routine) endeavor.

It builds in a process for regularly updating and reviewing the assessment based on new developments or actions taken. A risk management strategy can be developed and implemented by even the smallest of groups or projects or built into a complex strategy for a multi-site international organisation.

The process of identifying and reviewing the risks that you face is known as risk assessment. By assessing risks you are able to be actively aware of where uncertainty surrounding events or outcomes exists and identifying steps that can be taken to protect the organisation, people and assets concerned. How this is achieved and the level of detail which is considered can vary between organisations. In many circumstances, where staff or volunteers have a more hands-on role in the organisation, the Management Committee may not carry out the risk assessment themselves.

Risk Responses:

Management selects a risk response strategy for specific risks identified and analyzed, which may include:

Common challenges include:

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.