A merger refers to an agreement in which two companies join together to form one company. In other words, a merger is the combination of two companies into a single legal entity. In this article, we will look at different types of mergers that companies can undergo.

Motives for Mergers

Two companies may undertake a merger to increase the wealth of their shareholders. Generally, the consolidation of two businesses results in synergies that

increase the value of a newly created business entity. Other motives include:

Measuring the impact of merger

In order to fully analyze the impact, the company owners must compare the stand-alone acquirer to the newly combined business. An effective way of doing

this is through EPS accretion/dilution. This is a simple test that shows whether the proposed deal will increase or decrease the post-transaction earnings

per share (EPS) for the buyer. Using pro forma calculations to estimate the benefit of a merger or acquisition is important as it allows the acquirer to

determine what price he is willing/ able to pay.

Revenue synergies: Synergies that primarily improve the company's revenue-generating ability. For example, market expansion, production diversification,

and R&D activities are only a few factors that can create revenue synergies.

Cost synergies: Synergies that reduce the company's cost structure. Generally, a successful merger may result in economies of scale, access to new technologies,

and even elimination of certain costs. All these events may improve the cost structure of a company.

Types of Mergers

The term chosen to describe the merger depends on the economic function, purpose of the business transaction and relationship between the merging companies.

There are generally five different types of commonly-referred to types of business combinations:

Deal Structuring

One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered, such as antitrust laws,

securities regulations, corporate law, rival bidders, taxes, accounting issues, contacts, market conditions, forms of financing, and specific negotiation

points in the M&A deal itself.

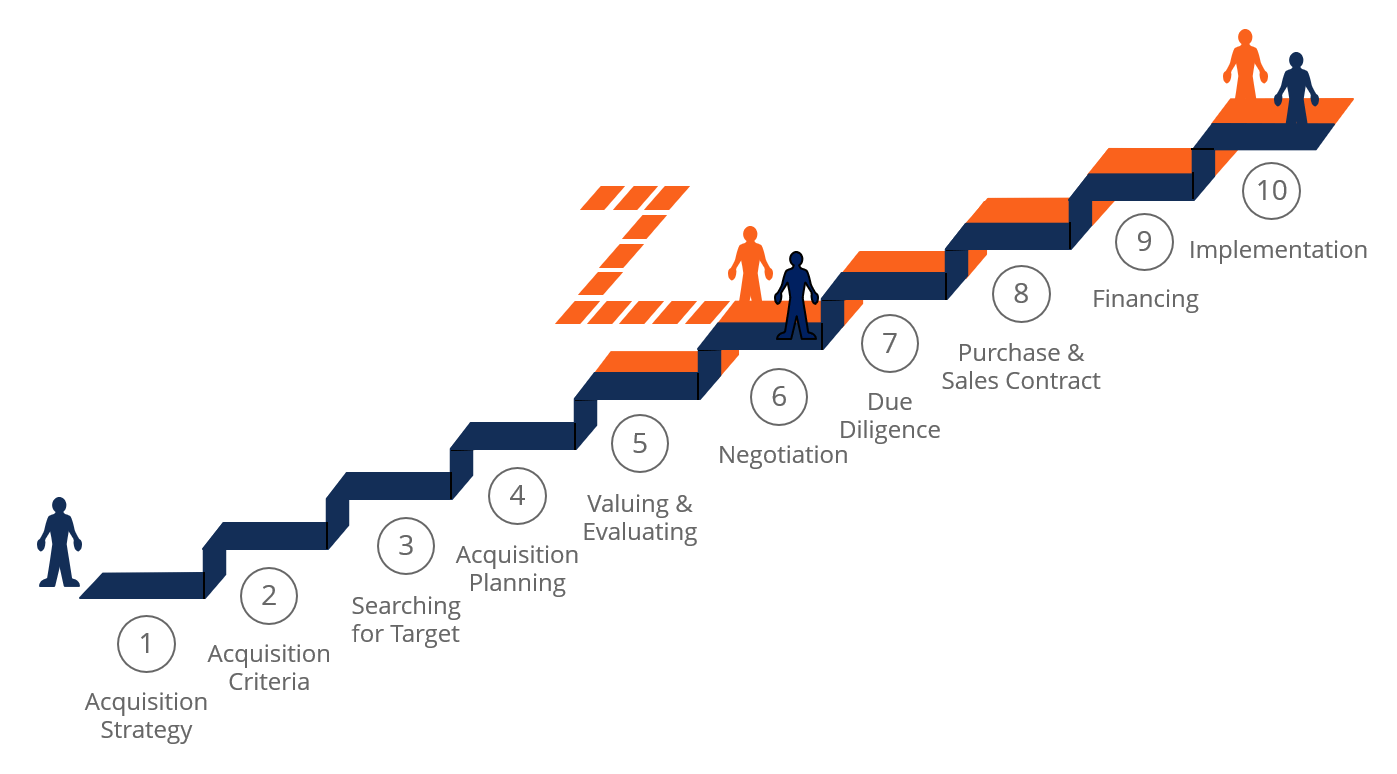

The mergers process has many steps and can often take anywhere from 6 months to several years to complete. Selling or buying a business can be painstaking. Having the right professionals on your side of the deal can make it a lot easier.

We help identify key risks and rewards throughout the life cycle, even for the most complex deals. We help you align deals with your strategic business objectives, maintain compliance and enhance value from integration and potential upside opportunity. Our team of specialists helps you focus on the key questions during the critical stages of planning and executing a merger.

We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

This insight into current market practice ensures we negotiate the best deal for you throughout your transaction. Our team has the experience to help guide and support management teams through the process. We advise management teams on structuring, valuation, financing and tax planning and assist them to approach the vendor with a credible bid.

Our team can engage with you to:

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.