As the current worldwide situation demonstrates, poorly informed or improperly executed risk management can mean disaster. Conversely, a well organised and focused risk process and strong risk management team will enable your company to maintain and strengthen your edge over your competitors. Moreover, studies have shown that financial risk is only the 'tip of the iceberg', as nearly 80% of key risks are not insurable. This critical 80% of risks must be 'insured' internally with a capable risk management team.

Risk management has been catapulted from being a useful tool to becoming the very pulse of the organisation and the yardstick by which its management is judged. The key is to recognise that risk is not something that should be avoided - a risk is often an opportunity in disguise.

The purpose of risk management training is to raise basic awareness of risk management concepts and mechanisms, to enable participants to identify and manage risks in their own units and to strengthen project management through adequate forward planning of potential risks.

The ability to manage these increasingly significant risks now represents the difference between a thriving organisation and one that is struggling to deal with the challenges facing it.

Many businesses in the region have realised that misunderstanding risk can lead to disaster. The organisations that have dealt with the recession most effectively have realised that this requires extensive knowledge of risk management tools and techniques.

The half-day training module on risk management introduces the definition of risk and the purpose of risk management and discusses steps towards the effective management of risks. The course goes beyond the provision of generic tools and extends to re-visiting elements of organizational culture, decision making and situational awareness. Practice case studies and exercises are proposed at the end of the training session, and participants are requested to undertake a mock risk analysis using the methodology described in the module.

Key benefits include:

* Improve efficiency of your internal Risk Management Team through their enhanced understanding of nuances and latest advancements in Risk Management.

* Reduce your costs of managing risks by bettering Risk techniques and deriving more value from your existing Risk Management Function.

* Improve your existing Risk processes with a better understanding of best-practices

* Analyze your risk reports better, with advanced understanding of Risk Analysis

* Get in sync with the Risk practices followed by some of the industry leaders

How does it work?

We've carefully designed our training program to include the most overlooked, most critical areas of Risk Management in your organization.

And we go about delivering these training programs in a very different way as well.

We undertake a quick 2-3 day study of various functions in your organization to assess their understanding of Risk Management, your existing

processes and tools and other risk related collaterals. It gives us a deeper understanding of your specific risk training needs allowing us

to customize our program according to your business, your commodities and your people.

* We conduct 1-day to 3-day on-site training programs for groups of 5 to 20 people.

* We do an in-depth analysis of your current processes and collaterals, and customize our training program accordingly.

* We interact with your people and group them based on their function and their current understanding of Risk Management, thereby avoiding

scenarios of training program being too complex or redundant for some individuals.

* We conduct an end-of-program evaluation to ascertain the level of Risk Management know-how of your people, so that you can

measure the value delivery.

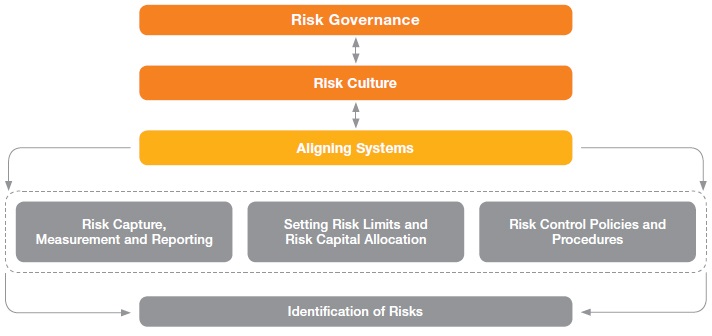

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.