What is Regulatory Risk?

Regulatory risk is the risk that a change in laws and regulations will materially impact a security, business, sector, or market.

A change in laws or regulations made by the government or a regulatory body can increase the costs of operating a business, reduce

the attractiveness of an investment, or change the competitive landscape.

Regulations can increase costs of operations, introduce legal and administrative hurdles, and sometimes even restrict a company from doing business.

Regulatory risk management

Regulatory risk management has assumed heightened importance since the global financial crisis and Great Recession that followed it.

While market and credit risk have always featured on senior management's agenda, external regulatory developments that have focused on greater transparency, capital adequacy, liquidity and consumer protection have triggered businesses to focus on effective risk management frameworks.

The US subprime mortgage crisis, which began in 2007, soon became an international banking crisis.

It exposed serious deficiencies in bank strategies and risk management. The basic business model of financial institutions has changed - today the focus is less on product profitability and more around customer needs.

The new watchword today is financial stability. Gaps detected in regulatory oversight and management are being plugged through more comprehensive frameworks and guidelines.

Financial services companies today face growing regulatory risk as authorities enforce compliance rigorously.

Major banks in North America, the European Union, Japan and Australasia today have to undergo stress tests, where different crisis scenarios are simulated to see how they would cope. Many have failed these tests and have had to further reorganize themselves.

Business professionals specialized in regulatory risk management are highly sought after today.

Where data quality is inadequate, risk and compliance management lacks a strong foundation. Responsible oversight by senior management and boards requires that these issues are given appropriate attention.

Financial Regulation

Financial institutions are often subject to regulations with regard to disclosure, investment strategies, and liquidity requirements.

For example, the alternative uptick rule was a rule passed by the United States Securities and Exchange Commission (SEC) in 2010 in efforts to preserve market stability and confidence. The rule ensures that a short sale order must be entered on an uptick (where the price of a security is higher than its previously traded price). It is invoked when a stock's price drops more than 10% in one day and heavily affects how investors who take short positions invest.

Breaking Down Regulatory Risk

Financial institutions face regulatory risk with respect to capital requirements, services, and products they are allowed to engage in,

and disclosure practices. Salient to investors that brokers serve would be a change in the amount of margin that investment accounts can

possess. If margin requirements are tightened, the impact on the stock market could be material, as this would force investors to either

meet the new margin requirements or sell off their margined positions.

Example of Regulatory Risk

For example, the utilities are heavily regulated in the way they operate, including the quality of infrastructure and the amount that can

be charged to customers. For this reason, these companies face a regulatory risk that can arise from events - such as a change in the rates

they can charge - that may make operating the business more difficult.

A plethora of regulatory risk examples exist. One of the best places to directly learn about this type of risk to a particular company is its annual filing (or 10-K). Each 10-K filing contains a section on material risks to company operations. Regulatory risks customarily are mentioned - and sometimes discussed in great detail, as is the case for the drug industry, for example. They're a common issue for omnibus accounts.

Regulatory risk is heightened when a new government administration takes office. Speculation, usually by the media, can encourage investors to move their money in other directions or simply sit on their hands and wait. In other words, new investments move elsewhere or dry up.

Even qualified professionals face regulatory risks. A change in the law could mean that people who formerly acted in a certain capacity are no longer authorized to do so.

Post-crisis regulatory risk

Since the global financial crisis of 2007/2008, the regulatory landscape has become considerably more complex. In the advanced economies,

supervision and enforcement has become much more confrontational, intensive and intrusive.

Today, regulators make judgments about both the robustness of regulated firms' business models, and the suitability of the goods they have on sale. If regulators see or anticipate problems, they now intervene straight away.

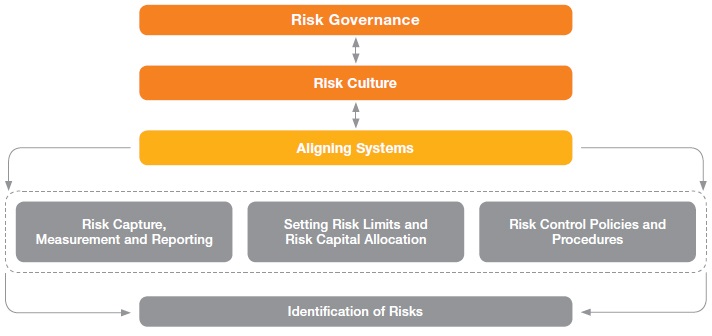

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.