In terms of development cycle, renewable energy (RE) projects entail funding supports from the technological innovation stage onwards. Due to uncertainties in resource availability and technical risk, only a limited variety of funding sources are available for startups. As the RE development project passes through this early stage into technical maturity, more funding sources may be attracted to bring it to commercial fruition. When the technology is eventually deployable to mass applications, even more funding venues exist, sometimes enabling exit of the original innovators via transfer of ownership, or fostering asset growth with investor participation in built facilities. Due to the environmental benefits to be harvested, governments have a pivotal role to play in relation to funding, either directly or indirectly at all stages.

Further, we find that even if the cost of debt goes down, issues with loan terms, access to low-cost equity, limits on foreign debt, and national banking practices are likely to present additional barriers for growth in the renewable energy sector in the medium and long term.

Conditions for renewable finance can be very different depending on the technology employed, the devel-oper, geography, or the requirements of the investors themselves. The most important distinction is between investors in the debt markets (lenders) and those in the equity markets (owners). Generally speaking, debt investors are more conserva-tive, accepting lower returns in exchange for lower risk. As such, their primary concern is that downsides are limited; that is, that the project does not fail. Equity investors are willing to take more risk in exchange for higher returns, and therefore focus equally on risk and the prospects of a project performing even better than expected. Under most circumstances, a project will be least expensive when it is funded by a mix of debt and equity, either at the project level, or through debt and equity secured at the corporate level.

Renewable energy financing can become costly when either debt or equity investors demand too high a return or when either is simply unavailable.

Thus, for both debt and equity we pose two sets of questions:

- Cost and terms: Are the returns investors are demanding and the conditions they are placing on their investment so onerous as to make the project economically unattractive? or;

- Availability: Is debt or equity just not available? That is, are there enough investors willing to invest or lend to renewable projects?

Significantly, while policy can influence the returns required by equity and debt investors and the availabil-ity of either, different policies are likely to be important to different classes of investors. To compound the problem, access to potentially lower cost international debt is limited due to regulatory barriers, the cost and risks associated with long-term currency swaps, and perceived country risks

We begin by noting that there are many factors that influence the total finance cost. Here we highlight five:

- The cost of debt

- The tenor of debt - that is, the length of time over which the debt is repaid

- Whether the debt is variable or fixed

- Extra risk that will be taken on by equity in the event that debt rates are variable

- The cost of equity, or the required return on equity (ROE)

Current and future impact of major issues in renewable energy finance

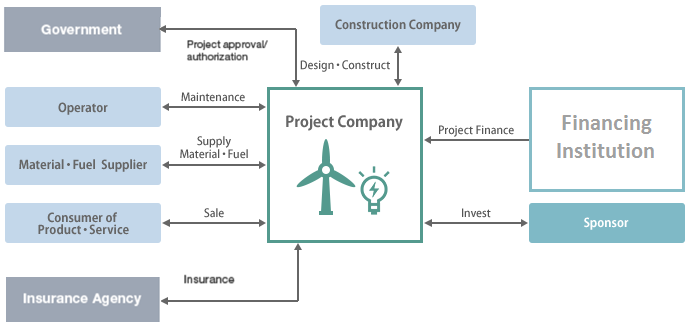

Project finance is the funding (financing) of long-term infrastructure, industrial projects, and public services using a non-recourse or limited recourse financial structure. The debt and equity used to finance the project are paid back from the cash flow generated by the project.

Project financing is essentially a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral. Project finance is especially attractive to the private sector because companies can fund major projects off-balance sheet.

A project financing is essentially a transaction in which the focus is on creating a secure source of revenue from the project in question (which remains to be constructed) to cover operating costs, service debt and deliver a return on investment to sponsors. The reliability of the project's revenue is heavily dependent upon the delicate balance between the project's commercial viability, legal certainty of the risk allocation in the various project documents and the overall "structure" of the project. Project financings typically involve a combination of third-party debt and sponsor equity, usually provided in a ratio of approximately 80/20 or thereabouts. The debt/equity ratio will change according to the lenders' perceived risk profile of the project in question and may also require the sponsors to make "standby" or "contingent" equity available in the event of construction delays or cost overruns, or in response to specific "in-country" risks. Projects in early-stage emerging markets will typically require greater equity commitments as a percentage of overall project costs from the project sponsors.

"Project structure" refers to the way in which the participants in a project have been organized in terms of their "risk relationship" and how that "risk relationship" has been reflected in the project and financing agreements for the project in question. In other words, it refers to the project's "architecture," that is, everything from the jurisdiction(s) through which sponsors infuse equity into the project (to take advantage of favorable investment treaty protections), to the jurisdictions in which the project company holds its bank accounts (to safeguard project revenues and provide adequate repayment security for lenders), to the way in which the key commercial arrangements for the project (for example, construction, operation and maintenance, fuel supply and power purchase) have been structured to reduce credit risk or promote performance reliability by those parties and therefore create revenue certainty for the project.

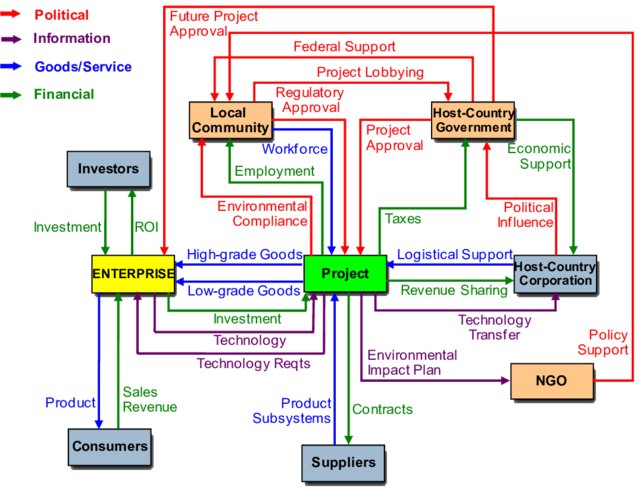

Stakeholder map for a multinational energy project :

Taking the economic and commercial viability of the project in question as a given, the creation of a successful project structure is possible only once the sponsors and lenders have gained a thorough understanding of the detailed legal, commercial and political risks affecting that project. This is referred to as the project's "risk profile." Such risk profile should cover the relevant project throughout its economic life, from its construction phase through its operating phase (particularly while senior debt remains outstanding).

Every project brings with it its own unique risk profile. However, there is a well-trodden path to follow when building up a project's risk matrix:

The emergence of non-bank lenders and challenger banks in the market place has not only provided competition on pricing but also access to a variety of new finance products. If you are looking to secure funding we are able to use our extensive experience and market insight to guide you through this process.

Our capital sources provide solutions across the spectrum, from fully amortizing long-term debt and non-recourse construction transactions to a highly leveraged mezzanine or bridge deal. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate debt placement opportunities at more favorable rates and terms than many of our clients could obtain independently.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.