What Is Credit Risk?

Credit risk is the possibility of a loss resulting from a borrower's failure to repay a loan or meet contractual obligations.

Traditionally, it refers to the risk that a lender may not receive the owed principal and interest, which results in an interruption

of cash flows and increased costs for collection. Excess cash flows may be written to provide additional cover for credit risk.

When a lender faces heightened credit risk, it can be mitigated via a higher coupon rate, which provides for greater cash flows.

Although it's impossible to know exactly who will default on obligations, properly assessing and managing credit risk can lessen the severity of a loss. Interest payments from the borrower or issuer of a debt obligation are a lender's or investor's reward for assuming credit risk.

Credit Risk = Default Probability x Exposure x Loss Rate

Where:

Default Probability is the probability of a debtor reneging on his debt payments.

Exposure is the total amount the lender is supposed to get paid. In most cases, it is simply the amount borrowed by the debtor plus interest payments.

Loss Rate = 1 / Recovery Rate, where Recovery Rate is the proportion of the total amount that can be recovered if the debtor

defaults. Credit risk analysts analyze each of the determinants of credit risk and try to minimize the aggregate risk faced by an organization.

1. Concentration risk

Concentration risk, also known as industry risk, is the risk arising from gaining too much exposure to any one industry or sector.

For example, an investor who lent money to battery manufacturers, tire manufacturers, and oil companies is extremely vulnerable to

shocks affecting the automobile sector.

2. Institutional risk

Institutional risk is the risk associated with the breakdown of the legal structure or of the entity that supervises the contract

between the lender and the debtor. For example, a lender who gave money to a property developer operating in a politically unstable

country needs to account for the fact that a change in the political regime could drastically increase the default probability and the loss rate.

Credit Risk, the Housing Bubble, and the Great Recession

Improper risk management by banks and other financial institutions was a key factor behind the US housing bubble in the mid-2000s

that eventually led to the 2008 recession. Commercial banks, investment banks, and other financial markets participants underestimated

both the default probability and the loss rate and consequently underestimated the credit risk they were facing.

In the lead-up to the recession, most lenders gave loans to individuals and businesses with questionable credit history. The fact was

most evident in the housing market, where easy credit led to house prices rising rapidly in the mid-2000s. Increased house prices meant

borrowers could refinance their mortgages and borrow even more money, which fueled the bubble even further.

Understanding Credit Risk When lenders offer mortgages, credit cards, or other types of loans, there is a risk that the borrower may not repay the loan. Similarly, if a company offers credit to a customer, there is a risk that the customer may not pay their invoices. Credit risk also describes the risk that a bond issuer may fail to make payment when requested or that an insurance company will be unable to pay a claim.

Credit risks are calculated based on the borrower's overall ability to repay a loan according to its original terms. To assess credit risk on a consumer loan, lenders look at the five Cs: credit history, capacity to repay, capital, the loan's conditions, and associated collateral.

Some companies have established departments solely responsible for assessing the credit risks of their current and potential customers. Technology has afforded businesses the ability to quickly analyze data used to assess a customer's risk profile.

If an investor considers buying a bond, they will often review the credit rating of the bond. If it has a low rating (< BBB), the issuer has a relatively high risk of default. Conversely, if it has a stronger rating (BBB, A, AA, or AAA), the risk of default is progressively diminished.

Bond credit-rating agencies, such as Moody's Investors Services and Fitch Ratings, evaluate the credit risks of thousands of corporate bond issuers and municipalities on an ongoing basis. For example, a risk-averse investor may opt to buy an AAA-rated municipal bond. In contrast, a risk-seeking investor may buy a bond with a lower rating in exchange for potentially higher returns.

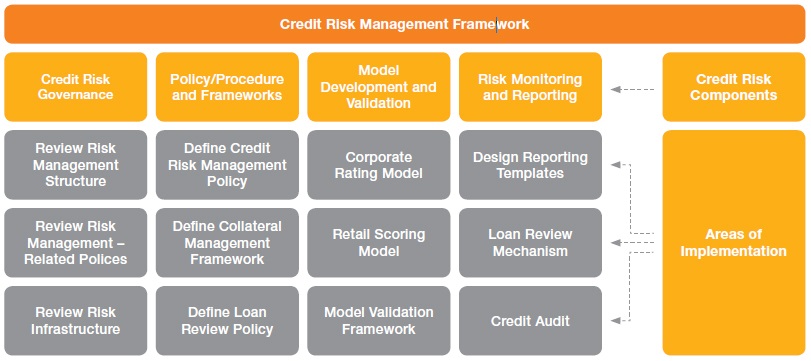

As a financial intermediary, the project finance division of a bank is exposed to risks that are particular to its lending and trading businesses and the environment within which it operates. The major goal of project finance in risk management is to ensure that it understands, measures, and monitors the various risks that arise and that the organization adheres strictly to the policies and procedures established to address these risks. Firms have a structured credit approval process which includes a well-established procedure for comprehensive credit appraisal.

What Factors are Used to Assess Credit Risk?

In order to assess the credit risk associated with any financial proposal, the project finance division of the firm first assesses a

variety of risks relating to the borrower and the relevant industry.

The borrower credit risk is evaluated by considering:

1. The financial position of the borrower, by analyzing the quality of its financial statements, its past financial performance, its financial flexibility in terms of the ability to raise capital, and its capital adequacy

2. The borrower's relative market position and operating efficiency

3. The quality of management, by analyzing its track record, payment record, and financial conservatism

Industry-specific credit risk is evaluated by considering:

1. Certain industry characteristics, such as the importance of the industry to the economic growth of the economy and government policies relating to the industry

2. The competitiveness of the industry

3. Certain industry financials, including return on capital employed, operating margins, and earnings stability

How are Credit Ratings Used?

After conducting an analysis of the specific borrower's risk, the credit risk management group assigns a credit rating to the borrower.

Generally, firms accept a scale of ratings ranging from AAA to BB (varies from firm to firm) and an additional default rating of D.

Credit ratings are the critical input for the credit approval process, as they help the firm to determine the desired credit risk,

spread over its cost of funds, by considering the borrower's credit rating and the default pattern corresponding to the credit rating.

Every proposal for a facility is reviewed by the appropriate industry specialists in the credit risk management group before being submitted for approval to the appropriate approval authority. Generally, the approval process for non-fund facilities is similar to that of fund-based facilities.

How Frequently are Credit Ratings Assessed?

Credit rating for every borrower is reviewed at least annually and is typically reviewed on a more frequent basis for high credit

risks and large exposures. Generally, the ratings of all borrowers in a particular industry are also reviewed upon the occurrence

of any significant event impacting the industry.

Working capital loans are generally approved for a period of 12 months. At the end of the 12 month validity period, the loan arrangement and the credit rating of the borrower are reviewed and the firm makes a decision on continuation of the arrangement and changes in the loan covenants that may be necessary.

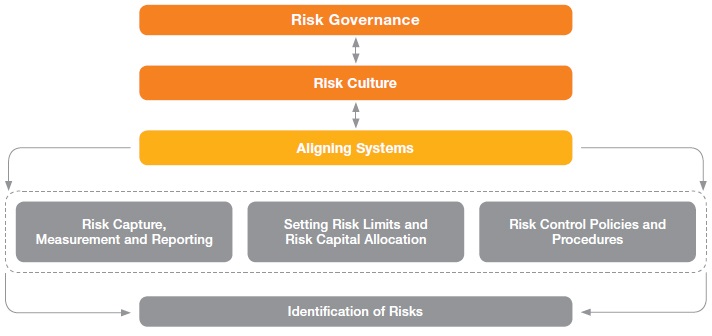

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.