Project finance is the funding (financing) of long-term infrastructure, industrial projects, and public services using a non-recourse or limited recourse financial structure. The debt and equity used to finance the project are paid back from the cash flow generated by the project.

Project financing is essentially a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral. Project finance is especially attractive to the private sector because companies can fund major projects off-balance sheet.

A project financing is essentially a transaction in which the focus is on creating a secure source of revenue from the project in question (which remains to be constructed) to cover operating costs, service debt and deliver a return on investment to sponsors. The reliability of the project's revenue is heavily dependent upon the delicate balance between the project's commercial viability, legal certainty of the risk allocation in the various project documents and the overall "structure" of the project. Project financings typically involve a combination of third-party debt and sponsor equity, usually provided in a ratio of approximately 80/20 or thereabouts. The debt/equity ratio will change according to the lenders' perceived risk profile of the project in question and may also require the sponsors to make "standby" or "contingent" equity available in the event of construction delays or cost overruns, or in response to specific "in-country" risks. Projects in early-stage emerging markets will typically require greater equity commitments as a percentage of overall project costs from the project sponsors.

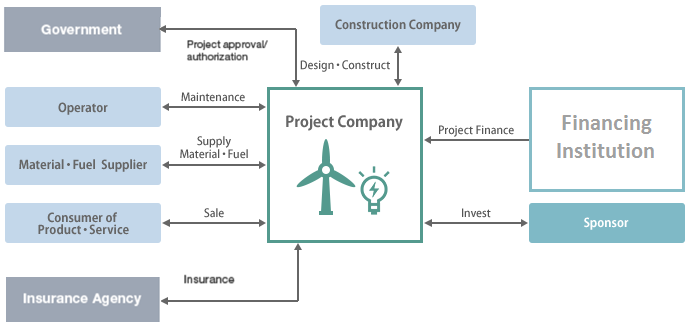

"Project structure" refers to the way in which the participants in a project have been organized in terms of their "risk relationship" and how that "risk relationship" has been reflected in the project and financing agreements for the project in question. In other words, it refers to the project's "architecture," that is, everything from the jurisdiction(s) through which sponsors infuse equity into the project (to take advantage of favorable investment treaty protections), to the jurisdictions in which the project company holds its bank accounts (to safeguard project revenues and provide adequate repayment security for lenders), to the way in which the key commercial arrangements for the project (for example, construction, operation and maintenance, fuel supply and power purchase) have been structured to reduce credit risk or promote performance reliability by those parties and therefore create revenue certainty for the project.

Taking the economic and commercial viability of the project in question as a given, the creation of a successful project structure is possible only once the sponsors and lenders have gained a thorough understanding of the detailed legal, commercial and political risks affecting that project. This is referred to as the project's "risk profile." Such risk profile should cover the relevant project throughout its economic life, from its construction phase through its operating phase (particularly while senior debt remains outstanding).

Every project brings with it its own unique risk profile. However, there is a well-trodden path to follow when building up a project's risk matrix:

The emergence of non-bank lenders and challenger banks in the market place has not only provided competition on pricing but also access to a variety of new finance products. If you are looking to secure funding we are able to use our extensive experience and market insight to guide you through this process.

Our capital sources provide solutions across the spectrum, from fully amortizing long-term debt and non-recourse construction transactions to a highly leveraged mezzanine or bridge deal. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate debt placement opportunities at more favorable rates and terms than many of our clients could obtain independently.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.