Factoring's origins lie in the financing of trade, particularly international trade. It is said that factoring originated with ancient Mesopotamian culture, with rules of factoring preserved in the Code of Hammurabi

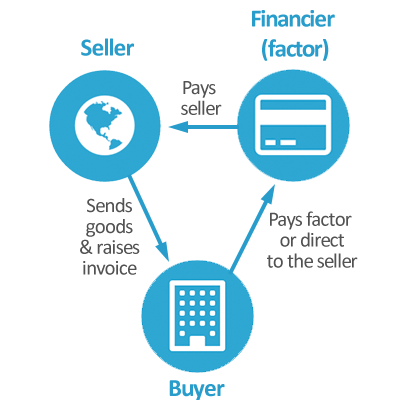

Invoice factoring is sometimes referred to as 'factoring', or 'debt factoring'. It is a financial product that enables businesses to sell unpaid invoices (accounts receivable) to a third-party factoring company (a factor).

The factoring company buys the invoices for a percentage of their total value and then takes responsibility for collecting the invoice payments.

Factoring is an increasingly popular form of alternative business funding. This type of alternative finance has grown in popularity since it has become more challenging for businesses with imperfect credit to use traditional finance products from high street banks.

Our capital sources provide solutions across the spectrum, from fully amortizing long-term debt and non-recourse construction transactions to a highly leveraged mezzanine or bridge deal. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate debt placement opportunities at more favorable rates and terms than many of our clients could obtain independently. We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals.

Advantages of factoring:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.