Operational risk is "the risk of a change in value caused by the fact that actual losses, incurred for inadequate or failed internal processes, people and systems, or from external events (including legal risk), differ from the expected losses". This definition, adopted by the European Solvency II Directive for insurers, is a variation from that adopted in the Basel II regulations for banks.

In October 2014, the Basel Committee on Banking Supervision proposed a revision to its operational risk capital framework that sets out a new standardized approach to replace the basic indicator approach and the standardized approach for calculating operational risk capital. The Basel II Committee defines operational risk as:

The risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This definition includes legal risk, but excludes strategic and reputational risk.

The Basel Committee recognizes that operational risk is a term that has a variety of meanings and therefore, for internal purposes, banks are permitted to adopt their own definitions of operational risk, provided that the minimum elements in the Committee's definition are included.

The following lists the seven official Basel II event types with some examples for each category:

Contrary to other risks (e.g. credit risk, market risk, insurance risk) operational risks are usually not willingly incurred nor are they revenue driven. Moreover, they are not diversifiable and cannot be laid off. This means that as long as people, systems, and processes remain imperfect, operational risk cannot be fully eliminated.

Operational risk is, nonetheless, manageable as to keep losses within some level of risk tolerance (i.e. the amount of risk one is prepared to accept in pursuit of his objectives), determined by balancing the costs of improvement against the expected benefits.

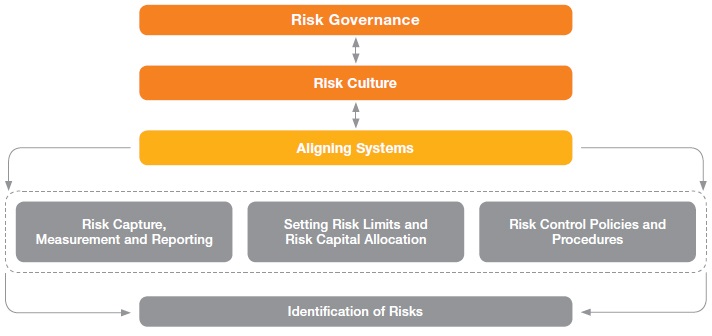

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Wider trends such as globalization, the expansion of the internet and the rise of social media, as well as the increasing demands for greater corporate accountability worldwide, reinforce the need for proper operational risk management.Until Basel II reforms to banking supervision, operational risk was a residual category reserved for risks and uncertainties which were difficult to quantify and manage in traditional ways - the "other risks" basket.

Challenges:

Our experts partner with clients on operational risk, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.