Liquidity risk is associated with an investor's ability to transact their investment for cash. Typically, investors will require some premium for illiquid assets which compensates them for holding securities over time that cannot be easily liquidated.

Before the global financial crisis (GFC), liquidity risk was not on everybody's radar. Financial models routinely omitted liquidity risk. But the GFC prompted a renewal to understand liquidity risk.1? One reason was a consensus that the crisis included a run on the non-depository, shadow banking system - providers of short-term financing, notably in the repo market - systematically withdrew liquidity. They did this indirectly but undeniably by increasing collateral haircuts. After the GFC, all major financial institutions and governments are acutely aware of the risk that liquidity withdrawal can be a nasty accomplice in transmitting shocks through the system - or even exacerbating contagion.

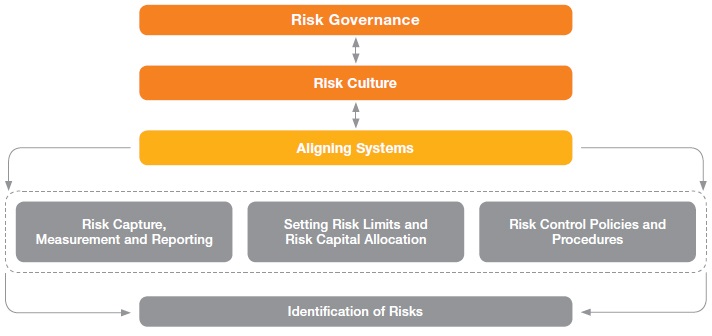

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

What Is Liquidity Risk?

Liquidity is a term used to refer to how easily an asset or security can be bought or sold in the market. It basically describes how quickly

something can be converted to cash. There are two different types of liquidity risk. The first is funding liquidity or cash flow risk, while

the second is market liquidity risk, also referred to as asset/product risk.

Funding Liquidity Risk

Funding or cash flow liquidity risk is the chief concern of a corporate treasurer who asks whether the firm can fund its liabilities. A classic indicator of funding liquidity risk is the current ratio (current assets/current liabilities) or, for that matter, the quick ratio. A line of credit would be a classic mitigant.

Market Liquidity Risk

Market or asset liquidity risk is asset illiquidity. This is the inability to easily exit a position. For example, we may own real estate but,

owing to bad market conditions, it can only be sold imminently at a fire sale price. The asset surely has value, but as buyers have temporarily

evaporated, the value cannot be realized.

Consider its virtual opposite, a U.S. Treasury bond. True, a U.S. Treasury bond is considered almost risk-free as few imagine the U.S. government will default. But additionally, this bond has extremely low liquidity risk. Its owner can easily exit the position at the prevailing market price.2? Small positions in S&P 500 stocks are similarly liquid. They can be quickly exited at the market price. But positions in many other asset classes, especially in alternative assets, cannot be exited with ease. In fact, we might even define alternative assets as those with high liquidity risk.

Market liquidity risk can be a function of the following:

The market microstructure. Exchanges such as commodity futures are typically deep markets, but many over-the-counter (OTC) markets are thin.

Asset type. Simple assets are more liquid than complex assets. For example, in the crisis, CDOs-squared-CDO2 are structured notes collateralized by CDO tranches became especially illiquid due to their complexity.

Substitution. If a position can be easily replaced with another instrument, the substitution costs are low and the liquidity tends to be higher.

Time horizon. If the seller has urgency, this tends to exacerbate the liquidity risk. If a seller is patient, then liquidity risk is less of a threat.

Note the common feature of both types of liquidity risk: In a sense, they both involve the fact that there's not enough time. Illiquidity is generally a problem that can be solved with more time.

Measures of Market Liquidity Risk

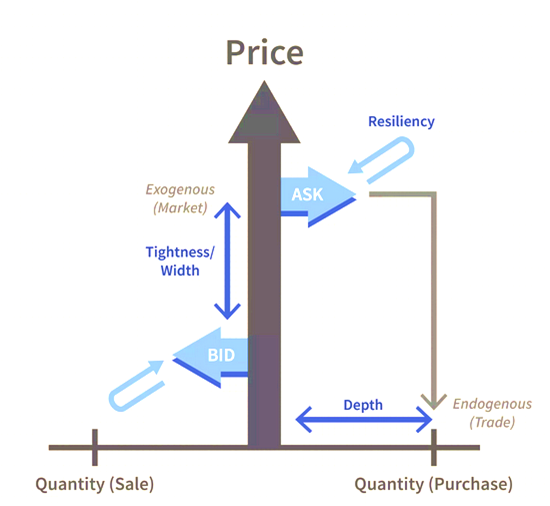

There are at least three perspectives on market liquidity as per the above figure. The most popular and crudest measure is the bid-ask spread.2?

This is also called width. A low or narrow bid-ask spread is said to be tight and tends to reflect a more liquid market.

Depth refers to the ability of the market to absorb the sale or exit of a position. An individual investor who sells shares of Apple, for example,

is not likely to impact the share price. On the other hand, an institutional investor selling a large block of shares in a small capitalization company

will probably cause the price to fall. Finally, resiliency refers to the market's ability to bounce back from temporarily incorrect prices.

Incorporating Liquidity Risk

In the case of exogenous liquidity risk, one approach is to use the bid-ask spread to directly adjust the metric. Please note: Risk models are different

than valuation models and this method assumes there are observable bid/ask prices.

A common way to include market liquidity risk in a financial risk model (not necessarily a valuation model) is to adjust or "penalize" the measure by adding/subtracting one-half the bid-ask spread.

Let's illustrate with value-at-risk (VAR).

Assume the daily volatility of a $1,000,000 position is 1.0%. The position has positive expected return,also referred to as drift,

but as our horizon is daily, we bring our tiny daily expected return down to zero. This is a common practice.

So let the expected daily return equal zero. If the returns are normally distributed, then the one-tailed deviate at 5.0% is 1.65.

That is, the 5% left tail of normal distribution is 1.65 standard deviations to the left of mean.

In excel, we get this result with =NORM.S.INV(5%) = -1.645.

The 95% value at risk (VAR) is given by:

$1,000,000 * 1.0% volatility * 1.65 = $16,500

Under these assumptions, we can say "only 1/20 days (5% of the time) do we expect the daily loss to exceed $16,500." But this does not adjust for liquidity.

Let's assume the position is in a single stock where the ask price is $20.40 and the bid price is $19.60, with a midpoint of $20. In percentage terms the spread (%) is:

($20.40 - $19.60) / $20 = 4.0%

The full spread represents the cost of a round trip: Buying and selling the stock. But, as we are only interested in the liquidity cost if we need to

exit (sell) the position, the liquidity adjustment consists of adding one-half (0.5) the spread. In the case of VaR, we have:

Liquidity cost (LC) = 0.5 x spread

Liquidity-adjusted VaR (LVaR) = position ($) * [-drift (%) + volatility *deviate + LC], or

Liquidity-adjusted VaR (LVaR) = position ($) * [-drift (%) + volatility *deviate + 0.5 * spread].

In our example,

LVaR = $1,000,000 * [-0% + 1.0% * 1.65 + 0.5 * 4.0%] = $36,500

In this way, the liquidity adjustment increases the VaR by one-half the spread ($1,000,000 * 2% = +$20,000).

The Bottom Line

Liquidity risk can be parsed into funding (cash-flow) or market (asset) liquidity risk. Funding liquidity tends to manifest as credit risk, or the

inability to fund liabilities produces defaults. Market liquidity risk manifests as market risk, or the inability to sell an asset drives its market

price down, or worse, renders the market price indecipherable. Market liquidity risk is a problem created by the interaction of the seller and buyers

in the marketplace. If the seller's position is large relative to the market, this is called endogenous liquidity risk (a feature of the seller). If

the marketplace has withdrawn buyers, this is called exogenous liquidity risk - a characteristic of the market which is a collection of buyers - a typical

indicator here is an abnormally wide bid-ask spread.

A risk management strategy provides a structured and coherent approach to identifying, assessing and managing risk or uncertainties followed up by minimizing, monitoring and controlling the impact of risk realities or enhancing the opportunity potential by applying coordinated and economical resources.

Adan's capabilities

Assessment, design and implementation of treasury, liquidity and capital risk management frameworks

Assessment, design and implementation of Risk Appetite Statements

Capital business strategy

Capital structuring

Funding and liquidity management organisation, oversight and governance

Allocation of funding and liquidity costs

Funding and liquidity planning

Liquidity systems and infrastructure

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.