Private placement is essentially investing money into a privately owned company. Investors may receive common shares, preferred shares, other forms of ownership interests, warrants, promissory notes (including convertible promissory notes), and bonds.

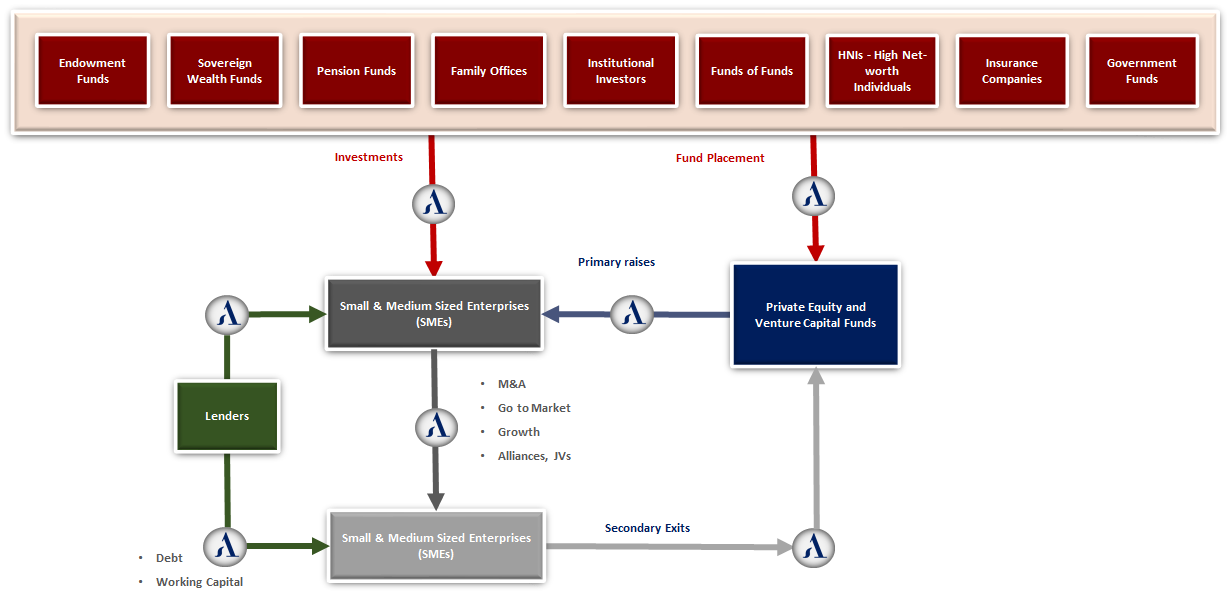

Our platform is global and we source capital from institutional investors around the world. We have close relationships with every class of investor including: public pension plans, sovereign wealth funds, consultants, funds of funds, insurance companies, corporate pension funds, endowments and foundations, family offices and wealth advisory firms. The strength of our LP relationships is derived from our reputation as a thought leader within the private equity industry and from the highly selective process we follow in adding a new client to our platform. In many ways, our rigorous screening and due diligence process emulates the process performed by the investors we cover.

We combine a top-down and bottom-up segmentation into a single figure process that enables us to screen and measure each opportunity against five key points of valuation: (i) team cohesion (ii) track record attribution (iii) sourcing and operating advantage (iv) global and local market positioning and (v) sector and industry dynamics. This combination provides a final segmentation that draws on the relative merits of both approaches and results in a confidence map of those managers most likely to outperform the broader market and deliver superior returns to the investor community.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.